By Leika Kihara

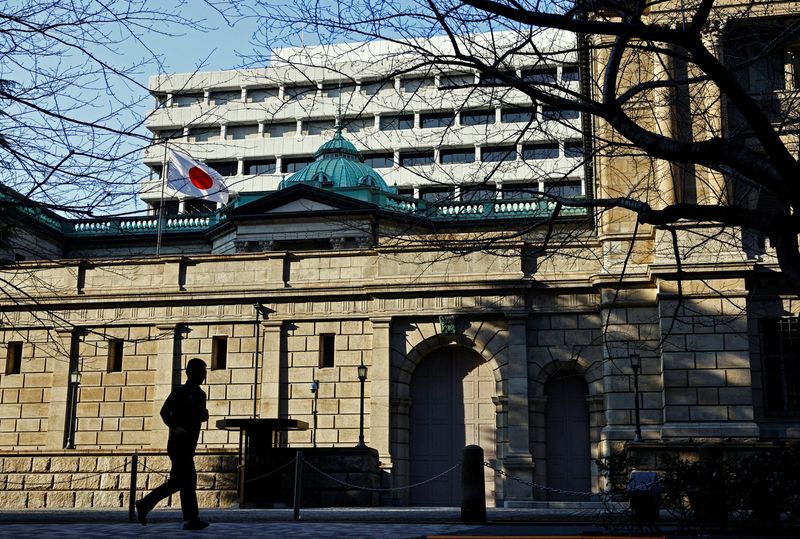

TOKYO (Reuters) – The Bank of Japan is expected to raise interest rates on Friday to levels unseen since the 2008 global financial crisis, as a broad worldwide stocks rally calms policymakers’ fears U.S. President Donald Trump’s tariff threats could upend markets.

With traders almost fully pricing in the chance of a rate hike, attention now shifts to any clues BOJ Governor Kazuo Ueda’s post-meeting briefing could offer on the pace and timing of subsequent increases in borrowing costs.

At the two-day meeting concluding on Friday, the BOJ is widely expected to raise its short-term policy rate from 0.25% to 0.5% – a level Japan has not seen in 17 years.

The move would underscore the central bank’s resolve to steadily push up interest rates near 1% – a level analysts see as neither cooling nor overheating Japan’s economy.

“Market hasn’t shown much negative reaction to Trump’s comments, so the BOJ will probably proceed with a rate hike,” said Naomi Muguruma, chief bond strategist at Mitsubishi UFJ (NYSE:MUFG) Morgan Stanley (NYSE:MS) Securities.

A hike by the BOJ would be the first since July last year when the move, coupled with weak U.S. jobs data, shocked traders and triggered a rout in global markets in early August.

Keen to avoid a recurrence, the BOJ has prepared markets with strong signals by Ueda and his deputy last week that a rate hike was on the cards. The remarks caused the yen to rebound as markets priced in a roughly 90% chance of a rate increase.

In a quarterly outlook report due after the meeting, the board is expected to raise its price forecasts on growing prospects that broadening wage gains will keep Japan on track to sustainably hit the bank’s 2% inflation target.

As inflation has exceeded the BOJ’s target for nearly three years and the weak yen has kept import costs elevated, Ueda is likely to stress that more rate hikes are forthcoming.

Many analysts already expect the central bank to hike rates again later this year, barring a Trump-induced market shock that hits global growth and Japan’s fragile economic recovery.

“After hiking to 0.5%, the BOJ will probably raise rates at a pace of roughly twice a year. As such, the next rate hike could happen in September,” said Mari Iwashita, executive economist at Daiwa Securities.

“Much will depend on how U.S. growth and inflation plays out, how that will affect the Federal Reserve’s policy and moves in the dollar/yen,” she said.

The domestic political calendar may also affect the BOJ’s rate-hike timing with an upper house election slated for July, when premier Shigeru Ishiba’s minority coalition could struggle to garner votes, some analysts say.

Since taking the helm in April 2023, Ueda dismantled his predecessor’s radical stimulus programme in March last year and pushed up short-term interest rates to 0.25% in July.

BOJ policymakers have repeatedly said the bank will keep raising rates, if Japan makes progress in achieving a cycle in which rising inflation boosts wages and lifts consumption – thereby allowing firms to continue passing on higher costs.