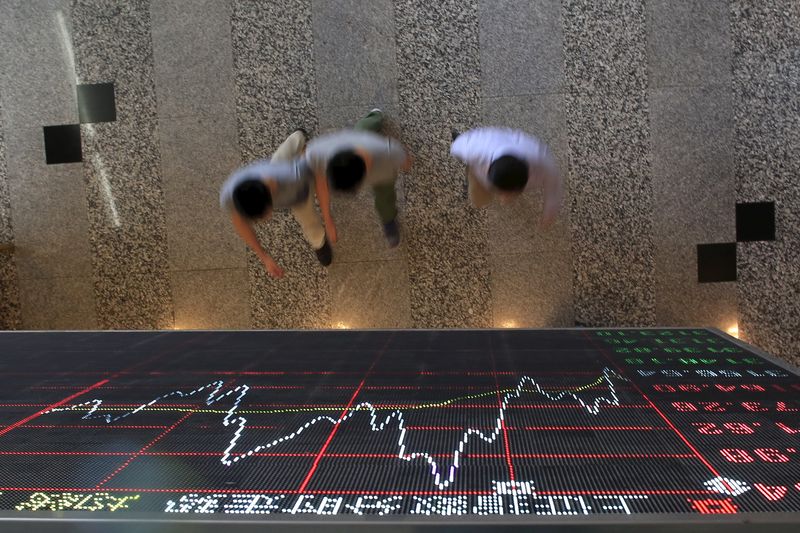

Investing.com– Chinese equity markets are not too concerned about U.S.-China tensions at the moment, a Goldman Sachs equity strategist told Bloomberg News in an interview on Tuesday, adding that stocks will record a 20% growth despite U.S. trade tariff concerns.

U.S. President Donald Trump assumed office on Monday and said he was mulling over additional tariffs of around 25% which could be announced on Feb. 1, but did not provide any other details.

“When it comes to tariffs, it’s still our base case that the U.S. will raise tariffs on China by about 20 percentage points this year, but the timing is highly uncertain,” Kinger Lau, chief China equity strategist at Goldman Sachs said in an interview with Bloomberg.

He emphasized that China should be able to digest additional tariffs this year.

There will be some positive response from the Chinese government to soften the external headwinds, as well as economic rebalancing from external demand to domestic demand, he said.

“So from the market standpoint, we’re still forecasting about 20% rise in China’s equities over the next 12 months,” Goldman Sachs’ Lau said.

In respect of earnings, excluding the impact of tariffs, Goldman Sachs expects low-teens earnings growth from Chinese corporates for this year.

But after factoring about 20% tariffs in their forecast, they expect about 7% growth, which is somewhat below consensus, Lau added.

Out of the expected 20% growth, 10% is expected to come from multiple expansions or multiple recoveries, and about 10% from earnings.