By Marcela Ayres

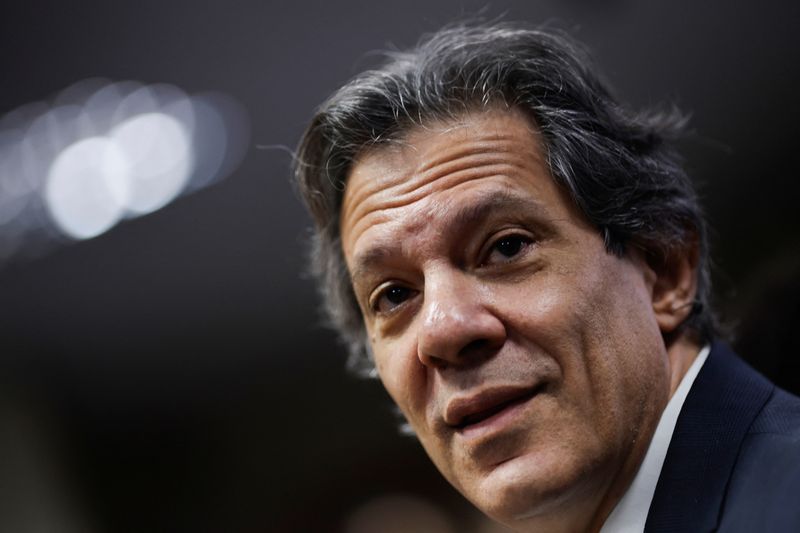

BRASILIA (Reuters) – Brazil’s Finance Minister Fernando Haddad said on Friday that high interest rates are poised to have a much stronger effect on inflation than many expect, dismissing fears that fiscal challenges could undermine the effectiveness of monetary policy.

“I don’t believe in fiscal dominance at this moment,” Haddad told CNN Brasil, referring to a scenario in which central bank rate hikes drive up government debt servicing costs, worsen fiscal conditions, and deteriorate market expectations, ultimately fueling inflation instead of containing it.

“I believe monetary policy will have an impact on inflation,” Haddad said. “And fiscal policy needs to be more persistent.”

Amid stronger-than-expected economic growth and a sharp weakening of the Brazilian currency, driven by global uncertainties as well as local fiscal concerns, the central bank signaled in December that it would implement two additional 100 basis-point rate hikes by March.

This would push the benchmark interest rate to 14.25%, its highest level in more than eight years.

Regarding the currency depreciation, Haddad stressed that Brazil operates under a floating exchange rate system but said he considered that “anything above 5.70 reais per dollar is expensive considering the country’s economic fundamentals.”

The Brazilian real was trading at around 6.05 per U.S. dollar on Friday, but it had weakened to nearly 6.30 at the end of last year.

Haddad also said that President Luiz Inacio Lula da Silva’s pledge to raise the income tax exemption threshold to 5,000 reais ($825.33) would hinge on introducing a minimum tax on all income earned by wealthy individuals.

($1 = 6.0582 reais)