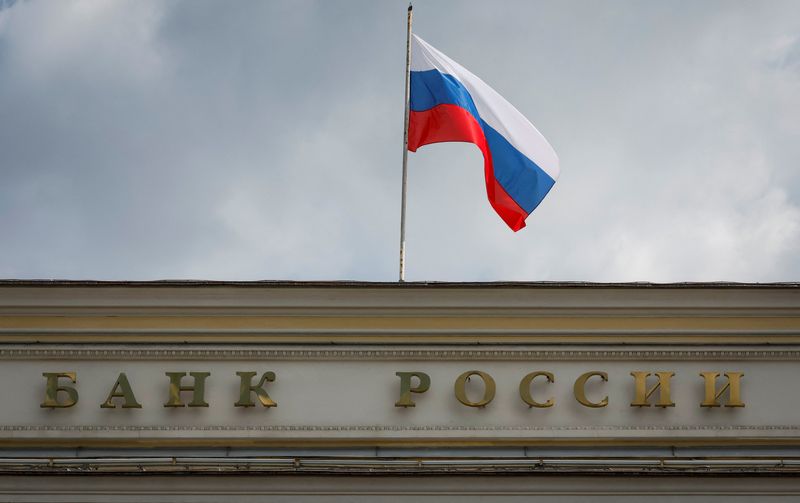

MOSCOW (Reuters) – The Russian central bank has sought to dismiss rumours about a possible freezing of retail deposits, which have seen explosive growth in recent months due to rising interest rates aligned with the regulator’s benchmark rate.

Russia’s benchmark rate rose to 21% last year, marking the highest level since the early years of President Vladimir Putin’s rule, as the central bank targets inflation driven by government spending and spiralling wage growth.

In response, banks offered customers short-term deposits with interest rates as high as 30%, prompting a frenzy as people shifted money between banks in pursuit of the best yields, along with concerns about a potential savings bubble forming.

Concerned about their savings, Russians inundated the central bank with questions about a possible freezing of deposits as a way to combat the emerging bubble, after retail deposits reportedly grew by one-third in 2024, according to official estimates.

“This idea is absurd. Besides being a gross violation of the rights of citizens and companies to manage their assets, such a step would undermine the foundations of the banking system and the financial stability of the country,” the regulator said on its Telegram channel.

VTB Bank estimated that Russians received around 7 trillion roubles ($68 billion) in interest on their deposits in 2024. The deposit rush drew money away from the stock market and the real estate sector.

Many Russians lost their savings due to hyperinflation following the collapse of the Soviet Union in 1991 and again during the banking sector meltdown in the 1998 Russian financial crisis.

The Russian banking system largely weathered the 2008-2009 crisis, as well as Western financial sanctions first introduced in 2014 following the annexation of Crimea.

After the start of Russia’s military action in Ukraine in 2022 all major Russian banks are under Western sanctions. However, the country’s banking system has so far avoided bank runs and bankruptcies.

“If deposits are frozen, people will lose trust in banks and the financial system as a whole for a long time,” the regulator said, emphasizing that such a measure would fuel inflation while rendering the key interest rate ineffective.

($1 = 102.9955 roubles)