Investing.com — BE Semiconductor Industries NV (AS:BESI) (BESI) has been identified by Bernstein analysts as their top investment idea for the first quarter of 2025.

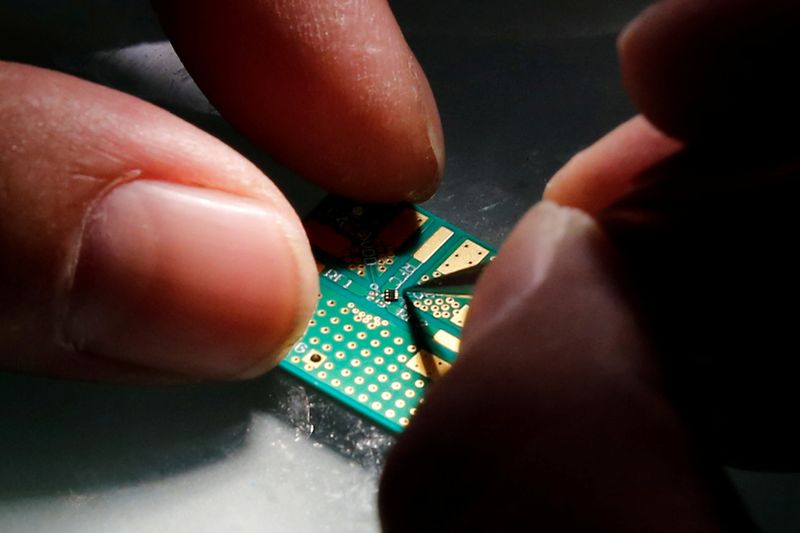

Despite navigating a challenging 2024, marked by delays in cyclical recovery and uncertainty around hybrid bonding adoption, the company is positioned to benefit from the improving semiconductor landscape.

Bernstein’s outlook reflects a shift to a more optimistic view, with tangible signs of recovery and robust advancements in semiconductor packaging technologies.

The semiconductor assembly market is projected to achieve a compound annual growth rate of 13% through 2028. BESI’s addressable market, driven by advanced die placement technologies, is expected to grow even faster, with a CAGR of 19%.

The segment forecast to grow at a 25% CAGR in 2023 was led by BESI with a 67% market share. By leading this niche, the company is positioned to capitalize on the next phase of semiconductor innovation.

While industry-wide cyclical recovery remained elusive throughout 2024, the semiconductor packaging segment—where BESI specializes—gained increasing importance, driven by AI-driven compute demands.

While cyclical recovery remained elusive throughout 2024, the semiconductor packaging segment-where BESI specializes-gained increasing importance, driven by AI-driven compute demands.

Known for its industry-leading gross margins, BESI is expected to reach a record 65% in 2024. Operating margins will remain strong at around 33%.

These figures are well above industry averages, showcasing BESI’s operational efficiency.

Hybrid bonding is emerging as a pivotal technology in advanced packaging. BESI’s involvement in this domain positions it as a critical player in the semiconductor ecosystem.

Analysts at Bernstein project that hybrid bonding, which contributed approximately 10% to BESI’s revenues in 2024, will account for nearly one-third of its revenues by 2026. This growth will be fueled by adoption in high-end products, including Apple’s Mac

CPUs expected in early 2026, and by increasing demand for 16-high stacks in memory applications.

BESI has also committed to advancing hybrid bonding technologies, with plans to launch its Generation 1+ systems in late 2025, promising improved accuracy and productivity.

By 2030, the company aims to expand its installed base of hybrid bonding systems to between 900 and 2,000 units.

Bernstein forecasts a robust recovery for BESI, with revenues projected to grow by 42% in 2025 and 38% in 2026, reaching €1.2 billion.

This strong performance is underpinned by BESI’s ability to outpace broader market growth, leveraging its leadership in advanced packaging technologies.

Earnings per share are expected to climb from €2.20 in 2024 to €5.70 in 2026, reflecting the company’s strong earnings momentum.

In light of these factors, Bernstein has raised its price target for BESI to €175, representing a 21% upside from its current trading price.

The valuation is based on a 30x multiple of the 2026 EPS estimate, which analysts believe is justified given BESI’s superior growth prospects and profitability metrics.