By Nell Mackenzie

LONDON (Reuters) – Government bonds remained under pressure on Thursday and the dollar held steady near its highest levels in more than a year as European stocks reversed early losses.

The pound headed for its biggest three-day drop in nearly two years, under pressure from a selloff in global bonds that has hit gilts especially hard, driving yields to 16-1/2-year highs, as concern mounts about Britain’s finances.

Sterling was last down 0.5% at $1.230, having touched its lowest since November 2023 earlier in the day.

Concern about rising inflation, reduced chances of a drop in interest rates, uncertainty over how U.S. president-elect Donald Trump will conduct foreign or economic policy, and the prospect of trillions of dollars in extra debt sales have sent bond yields soaring around the world this week.

This took European stocks lower at the open but they reversed to trade up 0.36% as of 1315 GMT.

The benchmark 10-year U.S. Treasury yield eased to 4.6526% from an overnight peak of 4.73%, which was the highest level since April 2024.

“This rout is not a UK but a global phenomenon. Sovereign debt is the elephant in the room. Will the UK achieve the growth we’d all like to see? The markets are not convinced,” said Russ Mould, investment director of AJ Bell in London.

The U.S. dollar index, which gauges the currency against sterling, the euro and four other major peers, edged up to 109.09, sitting not too far from the highest level since November 2022 of 109.54, reached a week ago.

PRESSURE POINTS

The latest boost for the dollar and U.S. Treasury yields follows recent signs of resilience in the U.S. economy and inflation, which prompted markets to reduce expectations for Federal Reserve rate cuts this year.

Minutes of the Fed’s December policy meeting, released on Wednesday, showed officials were concerned that Trump’s proposed tariffs and immigration policies may prolong the fight against inflation.

Selling in Treasuries on Wednesday accelerated after a CNN report that Trump was considering declaring a national economic emergency to provide a legal justification for a series of universal levies on allies and adversaries.

Markets are fully pricing in just one 25-basis-point U.S. rate cut in 2025, and see around a 60% chance of a second.

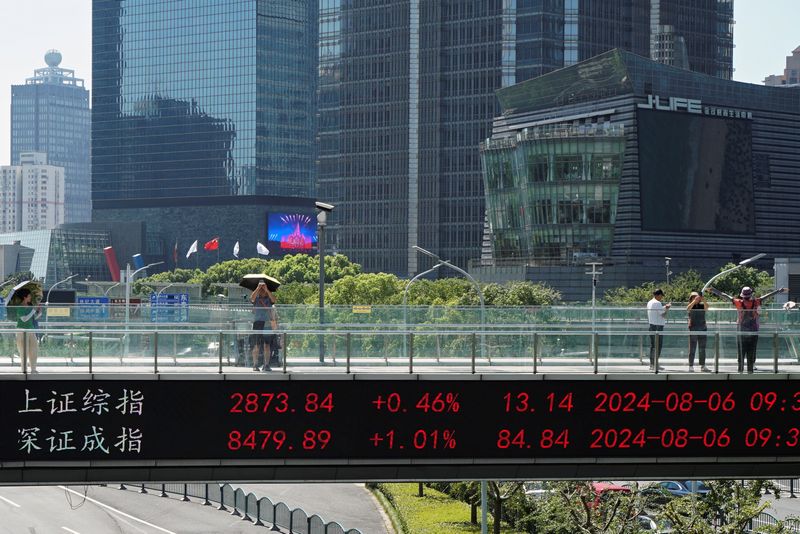

All that has combined to make global stock market sentiment fragile, and Asian equities closed lower on Thursday.

Chinese stocks slipped as official data underscored persistent deflationary pressure despite fresh government consumption stimulus, intensifying a scramble for offshore assets, while Hong Kong’s shares closed at a one-month low.

Mainland Chinese blue chips and Hong Kong’s Hang Seng ended down 0.3% and 0.2% respectively.

Japan’s Nikkei closed down almost 1%, as investors sold stocks to book profits after a recent rally, with chip-related shares dragging on the index the most.

U.S. stock markets are closed on Thursday to mark the funeral of U.S. president Jimmy Carter. U.S. bond markets close earlier at 1900 GMT.

On Friday, the closely watched U.S. monthly payrolls report will provide clues on the Fed policy outlook.

China’s yuan steadied near a 16-month low against the dollar as the nation’s central bank announced a record amount of offshore yuan bill sales to support the currency.

“This move underscores Chinese policymakers’ unwavering preference for currency stability,” said Shoki Omori, a strategist at Mizuho (NYSE:MFG) Securities, predicting the Chinese currency will firm to 7.22 per dollar by year-end.

Oil prices rose slightly on Thursday as investors factored in firm winter fuel demand expectations despite large U.S. fuel inventories and macroeconomic concerns.

Brent crude futures were up 38 cents, at $76.54 a barrel by 1320 GMT. U.S. West Texas Intermediate crude futures CLc1 gained 32 cents, or 0.4%, to $73.64.

Gold prices climbed 0.5% to $2,675.00 at $2,663 an ounce after hitting an overnight peak of $2,670.10, the highest since Dec. 13.

Leading cryptocurrency bitcoin tumbled 1.73% around $92,810, following a two-day slide of 7%.