By Ankur Banerjee

SINGAPORE (Reuters) – Asian stocks drifted lower on Wednesday, with a robust dollar keeping the yen pinned near six-month lows as traders wagered the Federal Reserve will likely be slow in cutting rates after data showed the U.S. economy and labour market remained stable.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.2%, with Japan’s Nikkei down 0.8%. On Wall Street, all three main indexes finished lower as the data stoked worries of a rebound in inflation. [.N]

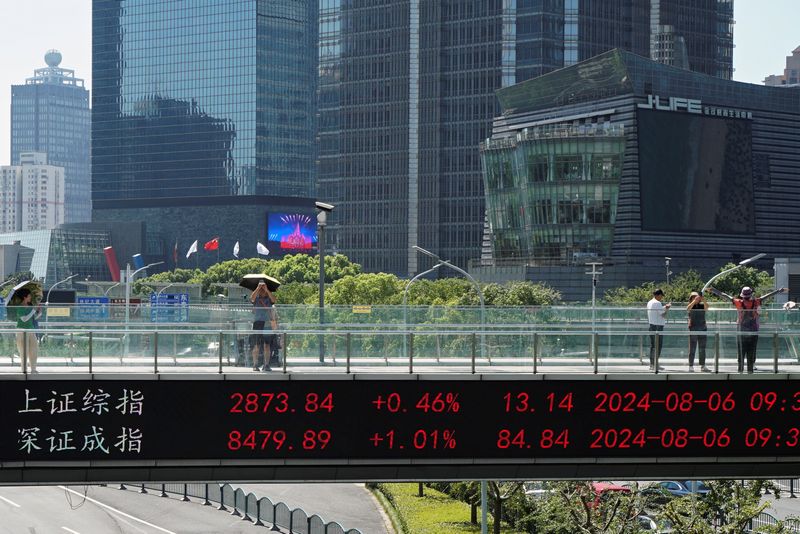

China’s blue chip CSI300 Index was 0.3% lower, while Hong Kong’s Hang Seng Index slid 0.55% in early trading. [.SS]

The yen was last at 157.98 per dollar after touching 158.425 on Tuesday, a level last seen in July when Tokyo intervened to support the yen. It slid more than 10% last year against the dollar and has had a rough start to 2025.

Investor focus in 2025 has been on shifting U.S. rate expectations, the growing divergence in policy path between U.S. and other economies and the threat of tariffs once President-elect Donald Trump steps into the White House on Jan. 20.

The Fed in December projected just two rate cuts for 2025, lower than the four it had earlier predicted. Markets are currently pricing in 38 basis point of easing this year with the first cut from the Fed fully priced in for July.

Data on Tuesday showed U.S. job openings unexpectedly increased in November while hiring softened, suggesting the labour market slowed at a pace that probably does not require the Fed to be in a rush to cut rates.

“It is certainly too early to call a re-acceleration in inflation from this round of data, and markets will take the bigger clues from non-farms on Friday,” said Kyle Chapman, FX markets analyst at Ballinger Group.

“With the market now firmly biased towards only a single rate cut this year, for me the room is only growing for a pullback in the overstretched hawkish repricing of the Fed path.”

Benchmark 10-year Treasury yields hit 4.699% after the data, the highest since April and was last at 4.6768% in Asian hours. [US/]

That left the dollar index, which measures the U.S. currency against six other major units, at 108.65, not far from the two-year high touched last week. The index rose 7% in 2024 as investors expect U.S. rates to stay higher for longer.

The spotlight will now be on the payrolls report due on Friday as investors parse through data to gauge when the Fed will next cut rates. Non-farm payrolls likely increased by 160,000 jobs in December after surging by 227,000 in November, a Reuters survey showed.

James Knightley, chief international economist at ING, said the combination of decent growth, elevated inflation concerns and a slowing, but not collapsing jobs market continues to see the market reducing the pricing on potential rate cuts this year.

“The risk is that a stronger jobs number and yet another 0.3% month-on-month core CPI print next week sees that being scaled back even more.”

The U.S. inflation report for December 2024 is scheduled to be released on Jan. 15.

In commodities, oil prices rose in early trading, with Brent crude up 0.34% at $77.31 per barrel, while U.S. West Texas Intermediate (WTI) crude was 0.5% higher at $74.63 a barrel. [O/R]

Gold prices eased a touch under pressure from higher bond yields and a stronger dollar. They were last at $2,647 per ounce. [GOL/]