By Jonathan Stempel

NEW YORK (Reuters) – A U.S. government fund to compensate people swindled by Bernard Madoff announced its tenth and final distribution on Monday, saying it will have paid out $4.3 billion to 40,930 of the late Ponzi schemer’s victims.

Richard Breeden, the former U.S. Securities and Exchange Commission chairman who oversees the Madoff Victim Fund, said a final $131.4 million payout will go to 23,408 claimants, and mark the distribution of all available forfeited assets.

Victims including 38,860 individuals, as well as schools, charities and pension plans, will have recouped an average 93.71% of their proven losses when the fund created by the U.S. Department of Justice closes in 2025.

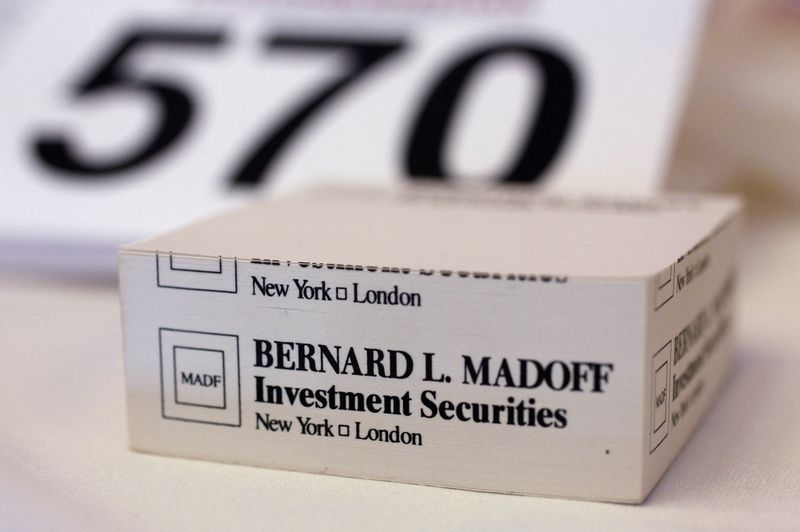

An additional $14.72 billion has been recouped for customers of the former Bernard L. Madoff Investment Securities LLC by Irving Picard, the trustee liquidating that firm following its 2008 bankruptcy.

That boosts the total payout to Madoff victims to about $19 billion. Unlike Picard, Breeden also returned money to victims who lost money indirectly, such as through “feeder” funds. Payouts went to claimants in 127 countries.

“Our objective was to find all of the victims, and know what everybody lost, to deploy the assets we had in the fairest and most equitable way,” Breeden said in an interview. “Nobody got left behind.”

Breeden also said it was important not to forget Madoff’s “complete depravity,” though it happened many years ago, and that people “remain wary and careful about how they invest their money and guard their savings.”

The fund was created mainly from settlements between the Justice Department and Madoff’s former bank JPMorgan Chase (NYSE:JPM), and between the liquidator of Madoff’s former firm and the estate of former Madoff investor Jeffry Picower.

It originally held $4.05 billion, but grew because the Justice Department recovered additional assets.

Madoff’s fraud was estimated as high as $64.8 billion.

It went undiscovered for many years until Madoff confessed to his sons in December 2008, one day after his firm’s Christmas party.

Madoff eventually pleaded guilty to 11 criminal counts. He died at age 82 in April 2021 while serving a 150-year prison sentence.