By Howard Schneider

WASHINGTON (Reuters) – Investors view it as a near given that the U.S. Federal Reserve will cut interest rates by a quarter of a percentage point at its Dec. 17-18 meeting, with more attention focused on policymakers’ new economic projections released alongside the decision.

Those projections will include an updated look at how much further Fed officials think they will reduce rates in 2025 and perhaps into 2026, an exercise that will have to account for data in the meantime showing stickier-than-expected inflation, a healthy labor market, a U.S. election result that could shift the global trade and immigration landscape, and ongoing geopolitical risks.

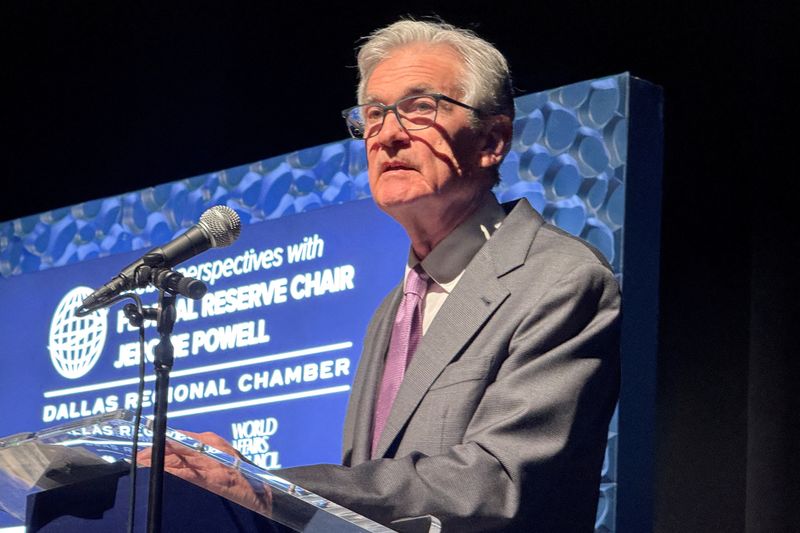

With so much to assess, a multitude of new risks, and a lot of uncertainty, many analysts expect the collective messaging from the central bank’s policy statement on Wednesday, Fed Chair Jerome Powell’s post-meeting press conference and the updated projections to be somewhat hawkish – with the Fed perhaps closer to a rate-cut stopping point, or at least very reluctant to commit to many more reductions in borrowing costs, than it was just a few months ago.

Here are some of the data points Fed policymakers will consider:

INFLATION’S STUBBORN DANCE

There hasn’t been much headline improvement in inflation since the Fed’s last economic projections in September or its Nov. 6-7 policy meeting. But some of the components have shifted around in ways that have left policymakers convinced a gradual easing of price pressures, known as disinflation, is underway. Housing cost increases have slowed and the Personal Consumption Expenditures Price Index, which the Fed uses to gauge progress toward its 2% inflation goal, appears headed for a low reading when data for November is released next week. That won’t happen, however, until two days after the end of the Fed’s meeting.

HIRING HAS HELD UP

The job market remains one of the central bank’s great surprises. The unemployment rate has risen modestly since the Fed began aggressively raising rates in March of 2022, but at 4.2% remains below the national long-run average and right at the level the median Fed official considers to roughly represent full employment. Absent a bad surprise in December, the jobless rate is likely to end the year below the 4.4% level policymakers had penciled into their September projections.

Job creation, meanwhile, has slowed from the fever pitch of recent years, and has caused some policymakers to regard the labor market as running at a sustainable pace right now.

Such resilience, though, is one of the reasons policymakers say they want to be careful about future rate cuts, out of concern the economy is actually operating close to potential right now. Cutting the policy rate, currently set in the 4.50%-4.75% range, too far could buoy demand, stretch the economy’s ability to fulfill it, and raise inflation.

WAGES OFFSET BY PRODUCTIVITY

Another pleasant surprise in recent data: Workers continue to be more productive over time, and the improvements have been enough to take the edge off of wage increases that otherwise have been a bit too high for the Fed’s inflation comfort zone.

Unit labor costs to business, one key to whether a tight job market is feeding into price pressures, have been rising at a more tempered rate as a result.

DEMAND DOESN’T QUIT

Another sign of economic resilience has been consumer spending, which doesn’t show much sign of cooling beyond its return from the elevated levels of the COVID-19 pandemic to something more like the pre-pandemic trend.

As long as people are employed and earning, they will spend, one of the important conditions for the “soft landing” from elevated inflation that Fed officials feel they are close to achieving.