By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets.

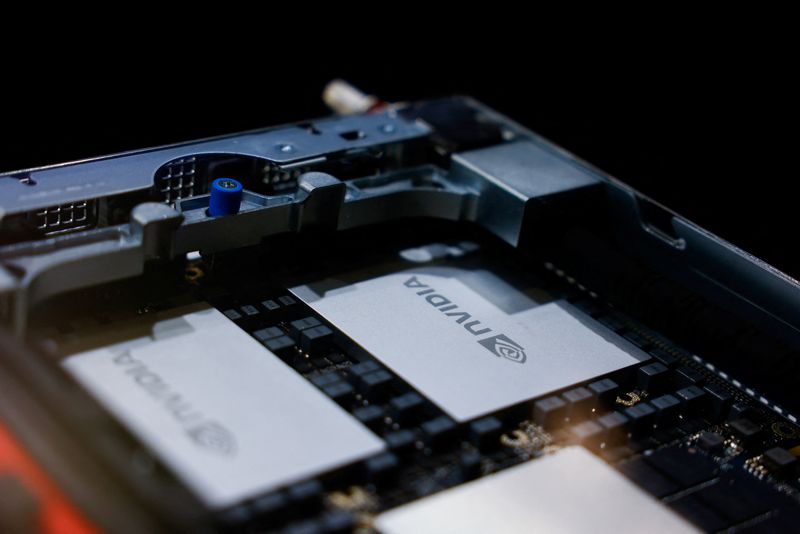

Geopolitical jitters rippled through world markets on Tuesday but subsided as the U.S. trading session progressed, allowing for a more positive tone in Asia on Wednesday as investors gear up for Nvidia (NASDAQ:NVDA)’s earnings announcement later in the day.

The local calendar on Wednesday sees the release of South Korean producer price inflation and trade figures from Japan and Taiwan. The latter is sometimes seen as a proxy for global demand as export orders include shipments from TSMC, the world’s leading contract chipmaker, and sales to China.

Monetary policy decisions from China and Indonesia are the main regional events. Both central banks are expected to leave rates on hold as policymakers seek to protect their exchange rates and keep their powder dry ahead of possible protectionist trade policies from the new U.S. administration next year.

The global backdrop to Wednesday’s Asian session looks relatively constructive, if tense. Investors will be on their guard after the rapid escalation in tensions between the U.S. and Russia over Ukraine.

After two U.S. officials and a source familiar with the decision said on Sunday that the Biden administration allowed Ukraine to use U.S.-made weapons to strike deep into Russia, President Vladimir Putin lowered the threshold for a nuclear strike in response to a broader range of conventional attacks.

This pushed global stocks into the red and sparked a spike in volatility on Tuesday – the S&P 500 VIX ‘fear index’ of implied U.S. equity volatility briefly popped up to its highest level since the Nov. 5 presidential election.

But the angst subsided. The S&P 500 and Nasdaq ended in the green, volatility and Treasury yields eased, and the U.S. dollar was little changed, making for a much more favorable backdrop for Asia on Wednesday.

Attention now turns to Nvidia, and analysts are hopeful the world’s largest company will deliver again.

The firm is expected by Wall Street to report a 82.8% increase in revenue to $33.125 billion in the August-October period, from $18.12 billion a year ago, according LSEG data.

Back in Asia, the People’s Bank of China is expected to leave benchmark lending rates unchanged on Wednesday, as last month’s rate cut squeezes banks’ profits and the yuan comes under fresh pressure with Donald Trump’s return to the White House next year.

All 28 market watchers in a Reuters poll think the PBOC’s one-year and five-year loan prime rates will be left on hold at 3.10% and 3.60%, respectively.

Bank Indonesia will also leave its seven-day reverse repo rate unchanged, at 6.00%, according to 25 of 34 survey respondents. Some of them revised their previous calls for a rate cut, and money markets now only expect a one-in-five chance of a cut next month.

Here are key developments that could provide more direction to markets on Wednesday:

– China interest rate decision

– Indonesia interest rate decision

– Japan trade (October)