By Patrick Wingrove

(Reuters) – Moderna (NASDAQ:MRNA) reported a surprise third-quarter profit on Thursday, driven by cost cutting and higher-than-expected sales of its COVID-19 vaccine, even with low revenue from its new respiratory syncytial virus shot.

The Cambridge, Massachusetts-based company posted a profit of $13 million, or 3 cents a share, for the quarter, compared to a loss of $3.6 billion a year ago. Analysts had expected a loss of $753 million, or $1.90 a share, according to LSEG data.

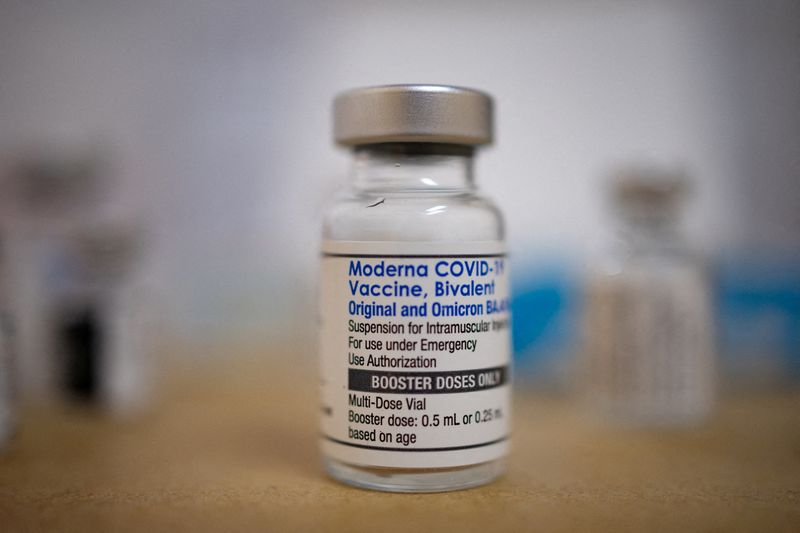

Moderna’s Spikevax COVID vaccine brought in sales of $1.8 billion, up 3.5% over the previous year and handily beating analysts’ average expectations of $1.38 billion. The company said it benefited from higher sales in the U.S. following an earlier launch of its COVID vaccine this year.

The U.S. Food and Drug Administration approved updated versions of Spikevax and rival vaccine Comirnaty from Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) nearly three weeks earlier than it did in 2023.

“We shipped more in the early days and were able to ensure all healthcare providers had access to COVID vaccines,” said Chief Financial Officer James Mock in an interview.

Sales of Spikevax outside the U.S. were lower than for the same period in 2023, when sales benefited from orders deferred from 2022, according to Moderna.

The company said expenses for the quarter were $1.93 billion, which was nearly 50% lower than the previous year, driven in part by less unused manufacturing capacity and fewer inventory write-downs.

Sales of Moderna’s new RSV vaccine mRESVIA were $10 million, far short of the $135 million analysts had expected, according to data compiled by LSEG.

Moderna has been banking on revenue from newer mRNA shots, including mRESVIA and an experimental COVID-flu combination vaccine, to make up for waning post-pandemic demand for COVID products.

“We were not able to compete during the heart of the contracting season because (mRESVIA) got approved in May,” Mock said. “Many of the contracts were already in place, as well as a substantial amount of inventory with customers already.”

U.S. market share for Spikevax was 40%, down from 45% in the third quarter of 2023, Moderna said.

Mock said around 7.5 million patients had received Spikevax this year. Nearly 11 million people have gotten Pfizer’s COVID shot in the same time, according to IQVIA data shared by an analyst.

Moderna confirmed that CEO Stephane Bancel will vacate his additional role as the company’s chief commercial officer and that President Stephen Hoge would take charge of sales as well as medical and research affairs.

The company said its executives Jacqueline Miller and Rose Loughlin had been promoted to the positions of chief medical officer and executive vice president for research, respectively.

The company reaffirmed that it expects sales of between $3 billion and $3.5 billion for the year. It said it had lowered the upper end of its forecast range for 2024 cost of sales to 40%-45% of product sales from 40%-50%.

Moderna said it is still on track to file for approval this year of its combined COVID-influenza vaccine, RSV shot for high-risk adults aged 18 to 59, and for its next generation COVID vaccine.

The company said it planned to use priority review vouchers to speed up the FDA applications for its COVID and RSV vaccines, but not for the combination vaccine.