By Kopano Gumbi

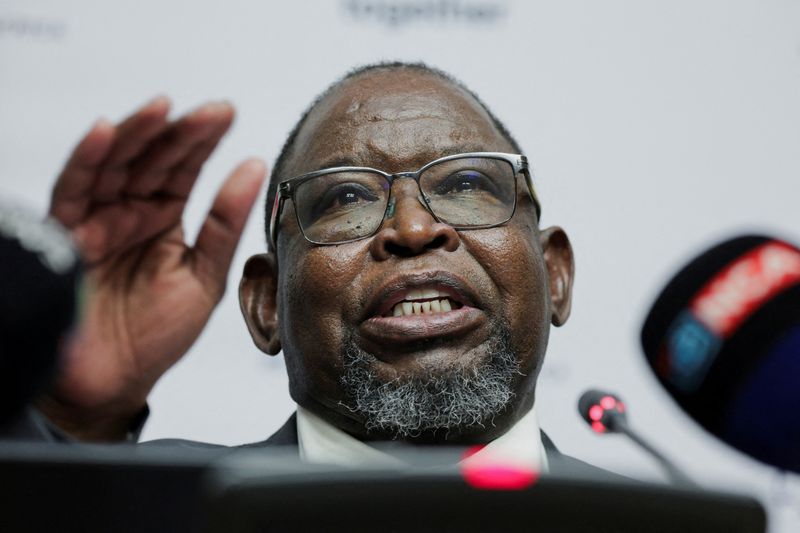

CAPE TOWN (Reuters) – South Africa’s Finance Minister Enoch Godongwana told Reuters on Wednesday that he was not yet convinced about lowering the country’s inflation target, a move which the central bank governor says is needed to make the economy more competitive.

Teams from the central bank and National Treasury, which falls under Godongwana, have been in discussions to identify a more appropriate inflation target than the current 3% to 6% range.

The target is set by the finance minister in consultation with the central bank governor.

“I’ve not firmed up my mind as to whether we should change the target, I don’t know whether the work will convince me otherwise,” Godongwana said in an interview, making his first public comments on the issue since the technical work got under way.

“To arrive at that target is not going to be painless, what are those costs associated with that and how are we going to cushion them? So that’s work that’s missing in my view.”

Inflation was above the midpoint of the target range – 4.5% – between May 2021 and July 2024. It dropped below the midpoint in August and again in September, to 3.8%, which some see as an opportune time to lower the target as inflation is at its lowest in more than three years.

Asked why he was not yet convinced, the finance minister cited the country’s difficult economic environment where poverty is still pervasive and unemployment near record highs three decades after the end of apartheid.

In a budget review on Wednesday, the government forecast wider budget deficits and higher debt over the next three years, but it anticipated improved growth prospects.

Godongwana said the work he had seen so far on the inflation target had been largely technical but that it had not addressed the political economy implications in one of the world’s most unequal societies.

Economists say there is a perception that lowering the target would automatically lead to tighter monetary policy, hurting economic growth.

South African Reserve Bank Governor Lesetja Kganyago has for years stressed his preference for a lower target, saying the current band is too wide and out of kilter with emerging market peers.

Last week, Kganyago told Reuters that he was hopeful the process of reducing the target would be concluded next year.