By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets.

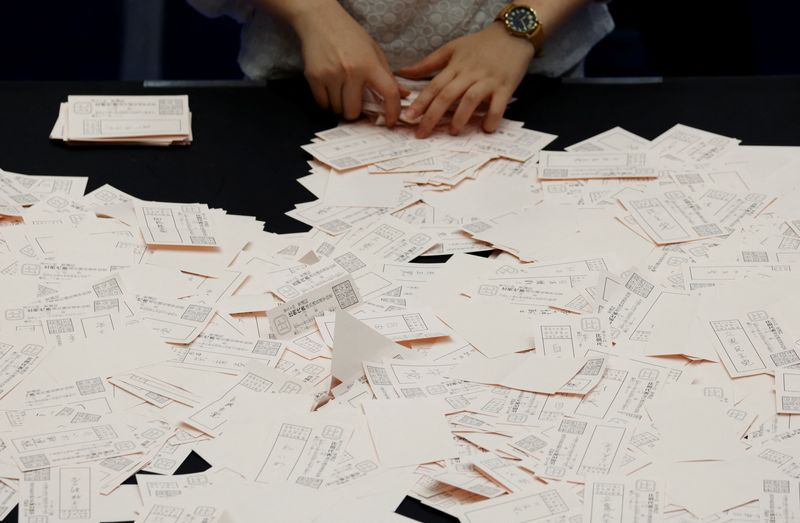

A hugely pivotal week for world markets begins with investors in Asia already bracing for volatile trading in Japanese assets on Monday after Prime Minister Shigeru Ishiba lost his parliamentary majority in the country’s general election.

Ishiba’s Liberal Democratic Party has ruled Japan for almost all of its post-war history, so the initial market reaction to a political earthquake of this magnitude could trigger a selloff in the yen and Japanese stocks, and higher Japanese Government Bond prices.

More broadly, the shockwaves could undermine the political stability and continuity many analysts say the Bank of Japan needs to conduct monetary policy. The BOJ sets interest rates on Wednesday.

The BOJ’s decision is one of several key events this week that could go a long way to shaping market and investment trends for the rest of the year. Five of the ‘Magnificent Seven’ megacap U.S. tech giants release company earnings this week, and U.S. nonfarm payrolls for October will be released on Friday.

Staying in Asia, purchasing managers index data this week will give the earliest insight into how economic activity across the continent held up in October, most notably in China. Is it too early for Beijing’s recent stimulus to have had any effect?

Probably. And the market impact is understandably beginning to fade too. Chinese stocks inched up 0.8% last week, consolidating after a few rollercoaster weeks.

Meanwhile, figures on Sunday showed industrial profits in China plunged 27.1% in September from a year earlier, the steepest fall this year.

Asian stocks more broadly softened last week, with the MSCI Asia ex-Japan index down nearly 2%, the third weekly decline in a row. Japan’s benchmark Nikkei 225 index fell 2.7% for its second consecutive weekly loss as investors reduced risk exposure ahead of Sunday’s general election.

Contrast that with the Nasdaq, which got a huge boost from Tesla (NASDAQ:TSLA)’s remarkable rally after its third-quarter earnings. The tech-heavy index rose for a seventh week in a row, and over the past year it has risen in all but 15 of the last 52 weeks.

The S&P 500 dipped slightly, although it is still hugging the previous week’s all-time high, while the Dow Jones shed more than 2%.

The emerging markets team at Barclays summed up the general mood pretty well: “The dollar is likely to remain on the front foot, and U.S. rates are likely to remain elevated, creating a somewhat painful backdrop for EM assets,” they wrote on Friday.

But with so much event risk looming, not least the U.S. Presidential election on Nov. 5, there may be a limit to how high Treasury yields can go this week.

Here are key developments that could provide more direction to markets on Monday:

– Fallout from Japanese election

– Hong Kong trade (October)

– Thailand trade (October)