Investing.com — “It’s the economy, stupid.” Political consultant Jim Carville’s famed quip from 1992 continues to ring true in U.S. presidential elections, and the 2024 race is certainly no exception.

Americans vote with their wallets. In fact, according to a new survey released by Investing.com, 83% of investors believe the election will have either a significant or moderate impact on financial markets – mirroring the 86% who agreed with the same line of thinking in our survey for the 2020 election.

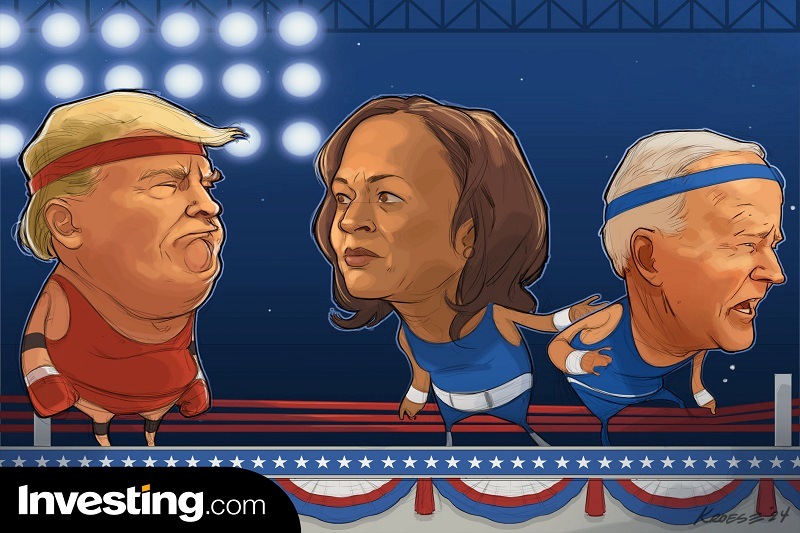

But which of this year’s candidates, former President Donald Trump or Vice President Kamala Harris, would produce a better outcome for the economy if elected? According to a survey of 1,117 Investing.com users and investors in the U.S. conducted October 8-18, 2024, Trump, the real estate mogul who touts his business acumen as a central component of his campaign, remains the most-trusted candidate among investors – as 61% state that the GOP contender’s victory would provide the best outcome for the stock market.

“Although the market and the Fed have already declared victory over inflation, the ghost of price rises still plays a key role in the average American’s daily life and, consequently, in the decision-making process when choosing who to vote for,” said Thomas Monteiro, senior analyst at Investing.com. “That is not only because wages have only now managed to grow faster than inflation but also because, with rates held at a high for an extended period, consumer credit is at a record high of $5.1 trillion – meaning that Americans are more indebted than ever.”

Yet notably, the 23% of investors who believe that a Harris victory would be the best result for financial markets represents a statistically significant increase over the 16% of respondents in our 2020 survey who placed their faith in Biden from an economic perspective when he was the Democratic candidate.

What might be behind this discrepancy? Given the inflation surge under Biden’s presidency, perhaps investors are simply more hopeful about the prospect of any fresh face in the Oval Office. At the same time, when investors are asked directly how replacing Biden with Harris on the 2024 Democratic ticket affects the economy, the jury is still out – 34% say the change has a “very” or “somewhat” positive impact, 35% a negative impact, and 32% little to no impact.

Fifty-five percent of investors think the economic performance of Biden’s presidency is a factor that hurts Harris’ chances of getting elected, with only 22% saying the Biden-era economy would help Harris. Eighty percent of investors say the current state of the economy, including inflation, affects their outlook on Harris as a potential presidential candidate (52% to a large extent and 28% to a moderate degree). Further, 61% believe the economic performance of Trump’s previous presidency help his chances of winning come November, and 60% feel his foreign policy would have a positive impact on the economy (compared to just 28% for Harris).

“Even though all signs point to that subsiding in the mid-term, with the economy remaining strong – in fact, debt-to-disposable-income remains at healthy levels – voters don’t look at these trends through the same lenses as the market does,” Monteiro continued. “They tend to vote more passionately, particularly given that we’re talking about a significant share of the population who has only experienced real inflation for the first time in their lives now. This does not bode well for Harris’ campaign, as her central motto for the economy has been more on the continuity side than anything else.”

Delving deeper into the potential economic implications of the election – particularly in specific industries – investors assert that the oil and gas sector will be the biggest beneficiary of a Trump victory. Seventy one percent believe oil and gas stocks would perform the strongest if Trump is elected, followed by cryptocurrency (46%), defense (46%), industrials (39%), technology (37%), real estate (35%), and finance companies (35%).

Meanwhile, investors anticipate that a Harris victory would yield the most significant boost in the market for renewable energy (52%), electric vehicles (47%), healthcare (40%), technology (30%), and defense (28%).

Investors’ expectations from sector to sector largely align with both candidates’ economic platforms and policies. Simultaneously, the projected strength of technology and defense stocks under either a Trump or Harris presidency speaks volumes about the stability of those sectors from investors’ perspective.

“Although each candidate may benefit a different sector of the economy more centrally, the outlook for the S&P 500 should remain optimistic regardless of who wins for reasons that exceed politics,” said Monteiro. “Corporate profitability is growing steadily, and with the no recession/low inflation scenario becoming the base case for the economy, the outlook for rates should also remain highly favorable.

Against this backdrop, the sweet spot for the market would be having a divided government, as that would diminish the particular risks associated with each candidate – that is, higher corporate taxation for Harris and an ad-hoc China policy for Trump. This holds particularly true given that the market seems to have looked past these risks so far.”

In some of the key battleground states that could swing the election, results varied considerably with the likes of Arizona and Nevada believing Harris to be a much closer candidate to Trump when judging the outcome of the economy, while the likes of Ohio and Florida were even more bullish on Trump than the national average.

See below:

Arizona (Trump – 53%; Harris – 47%)

Florida (Trump – 68%; Harris – 19%; No difference – 13%).

Georgia (Trump – 58%; Harris – 17%; No difference – 25%)

Michigan (Trump – 67%; Harris – 17%; No difference – 16%)

Nevada (Trump – 51%; Harris – 49%)

North Carolina (Trump – 70%; Harris – 23%; No difference – 7%)

Ohio (Trump – 75%; Harris – 3%; No difference – 22%)

Pennsylvania (Trump – 60%; Harris – 13%; No difference – 27%)

Wisconsin (Trump – 67%; Harris – 33%)

Regardless of the result on November 5, we know this much for certain: Investors are holding firm in their long-held belief that the election has a significant and multidimensional impact on the economy.