Investing.com — The recent stimulus announcements out of China have left investors raising questions about how to position themselves in case Beijing unleashes a more aggressive economic boost—a so-called “bazooka” stimulus.

In a Tuesday note, Barclays analysts acknowledge that this is not their base case, but they emphasize that investors should prepare for such a scenario due to its potential to significantly impact global markets.

Despite the recent rally in Chinese equities, the broader market reaction has been relatively subdued, leaving room for opportunities in other asset classes.

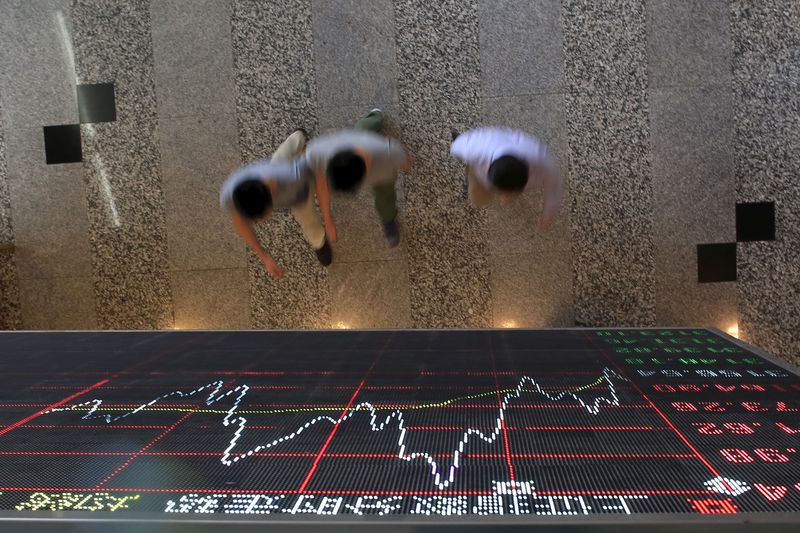

Chinese equities have shown some of their largest movements in history, with the CSI 300 posting a staggering 1-week sigma move of +17.6.

“The magnitude of these moves suggests that investors were unprepared for such announcements, and also that technicals, such as positioning, may have acted as a tailwind,” Barclays analysts noted.

“Additionally, it also indicates that while there may be further room for upside, the bulk of the move in the near-term may be over.”

The rally has largely been confined to Chinese equities and their proxies, such as European miners, but Barclays believes the real impact could come if China unveils a massive fiscal stimulus plan, like a CNY10 trillion package over two years.

In such a scenario, the effects could spill over into global markets, creating opportunities in non-Chinese assets.

“Notably, in a ‘bazooka’ scenario stimulus would likely have more farreaching effects on global assets, making upside opportunities on non-Chinese assets more attractive, given less extended moves and cheaper vol.,” analysts continued.

They outlined several strategies to capitalize on this potential, focusing on oil, industrials, and U.S. stocks with high exposure to China.

Among those, analysts discussed buying U.S. Oil Fund (USO (NYSE:USO)) calls, conditional on a stronger euro against the dollar, as oil is particularly sensitive to positive surprises in Chinese demand.

A second opportunity lies in industrials, where Barclays advises buying hybrid XLI (Industrials) vs. SPY (S&P 500) call spreads. The Chinese credit cycle has historically been a strong leading indicator for industrials’ performance, and a major stimulus could give this sector a significant boost.

Finally, for investors looking for direct exposure to U.S.-China trade, Barclays screens for companies with high Chinese sales exposure and attractive volatility profiles.

Top candidates include Wynn Resorts (NASDAQ:WYNN), Western Digital (NASDAQ:WDC), and Las Vegas Sands (NYSE:LVS), which could see significant gains if China’s economy rebounds on the back of stimulus.